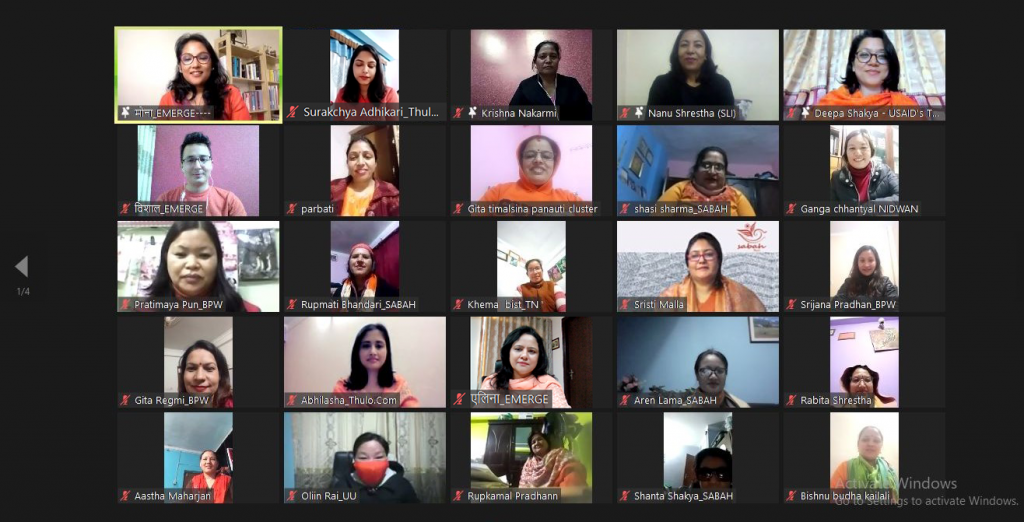

KATHMANDU: Thulo.Com and Enterprise for Management, Economic Reform and Gender Equality (EMERGE) organized webinars on ‘Banking, financial, and risk financing skills’ between 29th November to 1st December 2021.

The objective of organizing sessions on Banking, financial, and risk financing is to connect women producers/entrepreneurs with several banks and insurance companies so that they can avail of the government-subsidized loans and insurance schemes provided to Micro Small and Medium Enterprises, said Mona Shrestha Adhikari, CEO at EMERGE.

The webinars provided a platform where Banks and Insurance companies could impart knowledge on digital finance, banking, and insurance along with government norms and their respective services to the women-owned/led MSMEs, as well as women home-based producers. Rastriya Banijya Bank, Standard Chartered Bank, Nepal Investment Bank, United Insurance, and National Life and General Insurance (NLG) had participated in the webinar.

The findings of the pre-assessment survey conducted by the project before the training identified a gap between the need to approach banks and insurance companies and the hesitation in the participants to approach BFIs due to inadequate knowledge. Almost half of the women entrepreneurs/ producers had little knowledge on facilities provided by banks especially to women businesses and many were not aware of the different insurance schemes available for businesses, employees, and stocks.

Kiran Shrestha, CEO, Rastriya Banijya Bank mentioned that the Bank has prioritized the subsidized loan initiated by Nepal Government. He said, “We have provided subsidized loans to 3053 entrepreneurs, and among these 2416 are women entrepreneurs. Rastriya Banijya Bank is always ready to support women entrepreneurs and contribute to their empowerment. ”

Bijendra Suwal, Deputy General Manager, Nepal Investment Bank Ltd encourages women entrepreneurs to develop and learn new skills and assures that banks are there in making their journey better. He said: “To develop Nepal’s economy we need to encourage and delve into entrepreneurship. The Bank is here to promote and support entrepreneurs to contribute to Nepal’s economic development. ” Experts from NIBL and Standard Chartered Bank shared detailed information on various loan schemes including the Mahila Udhyamsheel Karza, a loan scheme that is targeted to support women entrepreneurs and the documents required to submit.

Sunil Ballav Panta, CEO, NLG Insurance said: “Women entrepreneurs need insurance along with loans to run a sustainable business. Insurance plays a vital role in protecting the business from losses due to uncertain events. We have made collaboration with banks who provide loans and we provide protection through our insurance coverage to support the entrepreneurs run a sustainable business.”

Experts of NLG Insurance and United Insurance shared about the types of insurances and the schemes to support SMEs and stressed the importance of insurance of both lives and livelihoods. Adding on they informed about various insurance schemes that cover loss or damage caused due to fire, earthquake, lightning, riot, strike, malicious damage, and terrorism, etc. They also shared how insurance coverage helps entrepreneurs to be prepared for the disaster and helps in rebuilding the businesses.

The online sessions are part of the training `Building Resilient Businesses’ provided to 120 plus women producers/entrepreneurs from 5 provinces, 11 districts, and 16 municipalities. Participants were interactive and suggested that more of such sessions should be organized to promote awareness of such government facilities provided via the banking and financial institutions, those that promote women’s entrepreneurship and economic empowerment.

The interaction was so intriguing that one of the entrepreneurs with disabilities was happy to know that banks provide loans to entrepreneurs with disabilities as well. Similarly, another entrepreneur found the sessions on insurance very informative and useful to all those who are in the agriculture sector.

Likewise, the Banks and Insurance companies expressed their interest to share information with wider communities and are happy to get an opportunity to participate in such platforms. Organizers believe that such events contribute to building resilient businesses particularly those of women producers/entrepreneurs. The event was organized by Thulo.com and Enterprise for Management, Economic Reform and Gender Equality (EMERGE) with the support of USAID’s Tayar Nepal – Improved Disaster Risk Management Project.