KATHMANDU: Liquidity in the banking system has slightly improved in the first week of May.

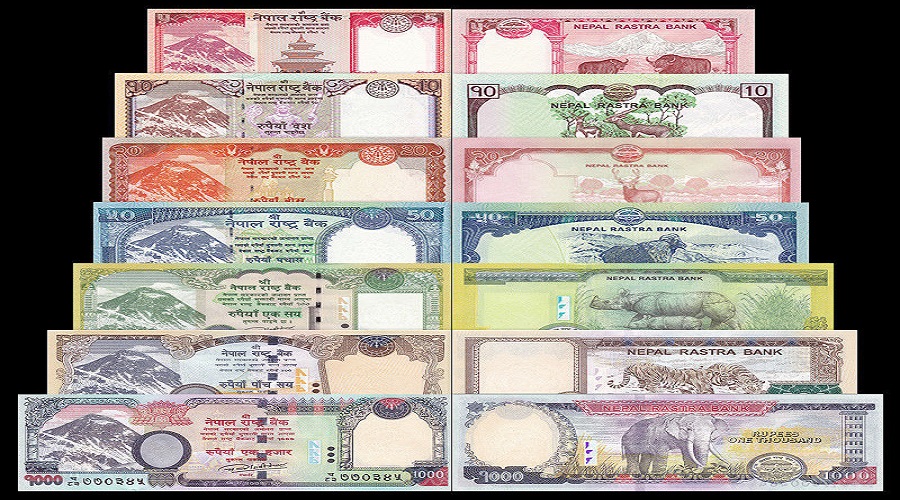

The excess liquidity that stood at Rs. 3.4 billion on April 21 has now begun rising in May. According to the Nepal Rastra Bank (NRB), the excess liquidity again bounced back with Rs. 25.6 billion on May 3. The rising excess liquidity augurs improvement in the availability of liquidity in the BFIs.

The BFIs have been persistently in the doldrum of shortage of liquidity in the current fiscal year (FY). At the beginning of mid-July, the excess liquidity was recorded at Rs. 125 billion, however, it slumped to Rs. 3.4 billion in on April 21.

Meanwhile, the deposit has been rising in line with the rise in the interest rate on the deposit. According to the Banking and Financial Statistics report of mid-March published by NRB, the average interest rate on year on year (YoY) basis, the deposit rose from 4.68 per cent in mid-March 2021 to 6.93 per cent in the mid-March 2022.

Subsequently, the overall deposit of the BFIs rose to Rs 4,903.3 billion in mid-March 2022 from Rs. 4,740 billion in mid-July 2021.

As the economy embarked on the path of recovery, the deposit mobilization seems improving which would help manage working capital for business and trade.

According to the Central Bureau of Statistics (CBS), the gross domestic product (GDP) at consumer price is projected to grow by 5.84 per cent in the FY 2021/22 from 3.8 per cent in the previous FY. The rise in the income level due to higher GDP can be expected to help raise the deposit mobilization which will ultimately ease the liquidity shortage.